Wacker Chemie (ETR:WCH) Rating Upped

Deutsche Bank AG upgraded shares of Wacker Chemie (ETR:WCH) to “Buy” rating in analysts note sent to investors on 2 October. The firm currently has a EUR 110.00 target price on the stock. Deutsche Bank AG’s target price would indicate a potential upside of 60.72% from the stock’s stock close price.

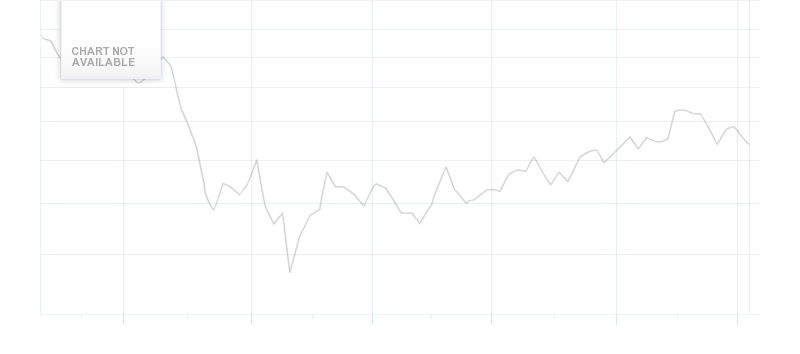

The firm’s rating upgrade is well received by investors, as ETR:WCH is currently trading 0.87% higher at EUR 68.50 as of 04:48 Frankfurt time. Wacker Chemie shares have dropped -24.43% over the past 200 days, while the S&P500 Index has declined -3.31% in the same time.

According to data compiled by Thomson Reuters, Wacker Chemie (ETR:WCH)’s stock is covered by 16 equity analysts across the Street, with 4 analysts giving it a Sell rating, 9 a Buy rating, while 6 consider it a Hold. The 12-month consensus target price for the stock is EUR 96.81, which reflects an upside potential of 41.33% over the current price.

Wacker Chemie (ETR:WCH) Profile

Wacker Chemie AG is a Germany-based company engaged in chemical industry. The Company operates through four business segments: WACKER SILICONES, which produces silicone products, ranging from silanes through silicone fluids, emulsions, elastomers, sealants and resins to pyrogenic silicas; WACKER POLYMERS, which offers a range of polymeric binders and additives; WACKER POLYSILICON, which provides polysilicon, and WACKER BIOSOLUTIONS, which is the life science division of the Company, offers solutions and products for the food, pharmaceutical and agrochemical industries. The Company offers its products for a range of sectors, including consumer goods, food, pharmaceuticals, textiles and the solar, electrical/electronics, basic-chemical industries, medical technology, biotech and mechanical engineering, automotive and construction.

Wacker Chemie (ETR:WCH) traded up 0.87% on 2 October, hitting EUR 68.5. A total of 127,106 shares of the company’s stock traded hands. This is down from average of 128,066 shares. Wacker Chemie has a 52 week low of EUR 65.13 and a 52 week high of EUR 117.80. The company has a market cap of 3.52B EUR and a P/E ratio of 11.93.