Google Inc (NASDAQ:GOOG) Rating Upgrade

In a report revealed to clients on Friday, 2 October, Oppenheimer has raised Google Inc (NASDAQ:GOOG) stock to Outperform and has set one year price target at $700.00. GOOG’s old rating was Perform.

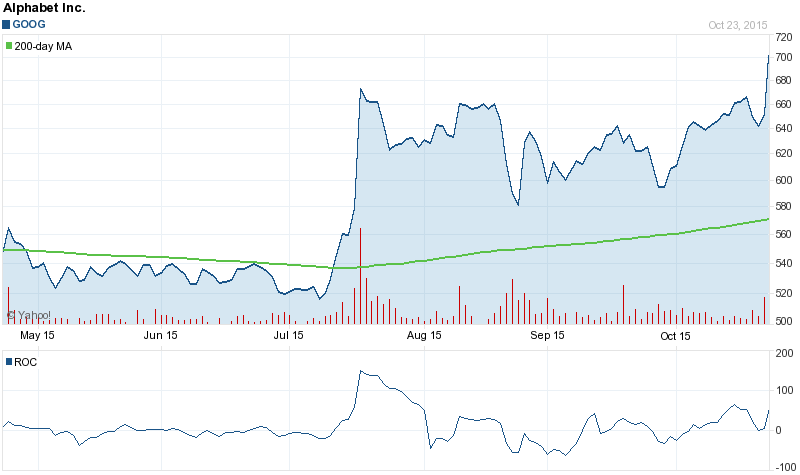

Despite this stock rating upgrade NASDAQ:GOOG is currently trading -0.84% lower at $606.16 as of 09:51 New York time. Google Inc. shares have gained 18.97% in the last 200 days, while the Standard & Poor’s 500 index has dropped -3.31% for the same time period.

According to data compiled by Thomson Reuters, Google Inc (NASDAQ:GOOG)’s stock is covered by 3 equity analysts across the Street, with 0 analysts giving it a Sell rating, 0 a Buy rating, while 0 consider it a Hold. The 12-month consensus target price for the stock is $645, which reflects an upside potential of 6.41% over the current price.

Institutional Ownership

Zenit Asset Management Ab had the most significant stake with ownership of 235,752 shares as of Q2 2015 for 19.07% of the US long equity exposure. Ancient Art L.P. is another bullish investment professional who is having 115,300 shares of Google Inc. or 13.64% of their US long equity exposure. Also, Kenmare Capital Partners L.L.C. have 11.02% of their US long equity exposure invested in the company for 29,725 shares. The New York-based fund Farley Capital Ii L.P. disclosed it had purchased so far a stake worth about 8% of the investment professional’s stock portfolio in Google Inc.. The New York-based fund Two Creeks Capital Management Lp is also positive about the stock, possessing 19,923 shares or 7.76% of their US long equity exposure.

Insider Activity

Over the last six months, Google Inc. NASDAQ:GOOG has seen 0 buying transactions, and 88 insider sales. The net result was for 88 transactions, worth $15.09B.

Google Inc (NASDAQ:GOOG) Profile

Google Inc. (Google) provides its products and services in more than 100 languages and in more than 50 countries, regions and territories. The Company offers a range of products across screens and devices. The Company delivers both performance advertising and brand advertising.

Google Inc (NASDAQ:GOOG) traded down -0.84% on 2 October, hitting $606.16. A total of 30,199 shares of the company’s stock traded hands. This is down from average of 2.60M shares. Google Inc. has a 52 week low of $487.56 and a 52 week high of $678.64. The company has a market cap of $423.74 billion and a P/E ratio of 30.48.