Anand Nallathambi Insider Sell

Anand Nallathambi, an insider of Corelogic Inc, currently President and CEO a few days ago disclosed a deal with the Washington-based Security and Exchange Commission. As announced in the electronic form, Anand Nallathambi made a sale of 15,000 shares of the California-based company, priced at $37.1 per share. $556,467 US Dollars was the deal’s value. The SEC report’s date was October 02, 2015. Anand Nallathambi now indirectly has rights to 162047 shares. He also directly has rights to 251366 shares. In total he holds a stake of 0.46%.

Corelogic Inc Sentiment and Fundamentals

If Corelogic Inc makes $1.82 per share as predicted by thirteen Wall Street equity analysts, the company will have 20.81 forward PE. They further expect Corelogic Inc EPS to growth Year-Over-Year by about 12.33%.

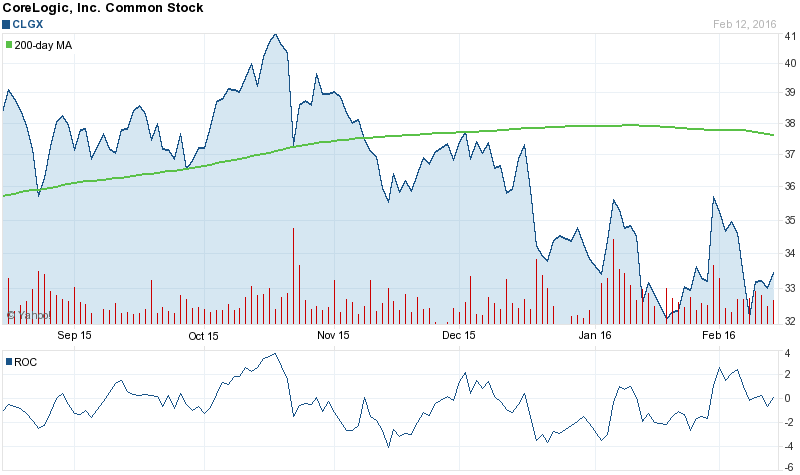

Within the last 50 days, Corelogic Inc stock price had a 7.70% decrease. Its trend is down. Based on Anand Nallathambi’s most probably clever move and our live-tested equities time-momentum model as illustrated on the chart below, we rate Corelogic Inc’s stock as “Sell” - selling makes sense.

Legendary stock traders, who also include David Tepper, once claimed that the best money is made when fundamental and technical analysis are combined.

Institutional Ownership

Review of SEC filings reveal that 224 institutional investors have shares of Corelogic Inc. In the last quarter, the firm had 83.24% institutional ownership. That is a very high interest. They decreased by 1.53 million the total shares they hold. As of that quarter these professional stock holders owned 74.15 million shares. There were 68 funds that created new positions and 80 funds that added to their positions. A total of 18 funds closed their positions in Corelogic Inc and 61 reduced their holdings.

This stock is held by two institutional advisors in their Top 10 stock positions. These are: Fourpoints Investment Managers S.A.S., Seabridge Investment Advisors Llc.

Keeley Asset Management Corp is the most bullish institutional investor on Corelogic Inc, with ownership of 645,090 shares as of Q2 2015 for 0.61% of the fund’s portfolio. Leisure Capital Management is another bullish player having 12,100 shares of the company or 0.47% of their stocks portfolio. The stock is also 0.17% of the fund’s AUM. Further The New York-based fund Fourpoints Investment Managers S.A.S. have 2.89% of their stock portfolio invested in the company for 319,000 shares. Seabridge Investment Advisors Llc revealed it had purchased a stake worth 1.92% of the fund’s stock portfolio in Corelogic Inc. The Arizona-based fund Leonard Capital Management Inc is also optimistic about the company’s stock, possessing 101,799 shares or 1.40% of their stock portfolio.

Corelogic NYSE:CLGX Company Profile

CoreLogic, Inc. is a property information, analytics and data-enabled services provider operating in North America, Western Europe and Asia Pacific. The Company provides detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. It operates through two segments: Data & Analytics and Technology and Processing Solutions. The Data & Analytics segment owns or licenses data assets, including loan information, criminal and eviction records, employment verification, property sales and characteristic information, property risk and replacement cost and information on mortgage-backed securities. The Technology and Processing Solutions segment provides property tax monitoring, flood zone certification and monitoring, credit services, mortgage loan administration and production services, lending solutions, mortgage-related business process outsourcing, technology solutions and compliance-related services

Company Website: Corelogic

Now its market capitalization is: $3.38 billion and it has 90.81 million outstanding shares. The firm has 4820 employees. Today there are 85.25% shareholders and the institutional ownership stands at 85.25%. Corelogic Inc was created in Delaware on 2009-10-13. The stock closed at $37.889999 yesterday and it had average 2 days volume of 69480 shares. It is down from the 30 days average shares volume of 122965. Corelogic Inc has a 52w low of $25.63 and a 52weeks high of $42.24. The stock price is above the 200 days Simple moving average. Corelogic Inc last issued its quarterly earnings data on 07/23/2015. The company reported 0.48 EPS for the quarter, above the consensus estimate of 0.44 by 0.04. The company had a revenue of 386.01 million for 6/30/2015 and 364.77 million for 3/31/2015. Therefore, the revenue was 21.24 million up.

Anand Nallathambi is also Chief Executive Officer of First Advantage Corp.

* Includes unvested restricted stock units and performance-based restricted stock units granted prior to February 27 - 2013.

* This transaction was made pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on December 15 - 2014.

* Since August 5 - 2015 - the reporting person acquired .262 shares of CoreLogic - Inc. stock under the CoreLogic - Inc. 401(k) Plan. The information in this report is as of September 30 - 2015.