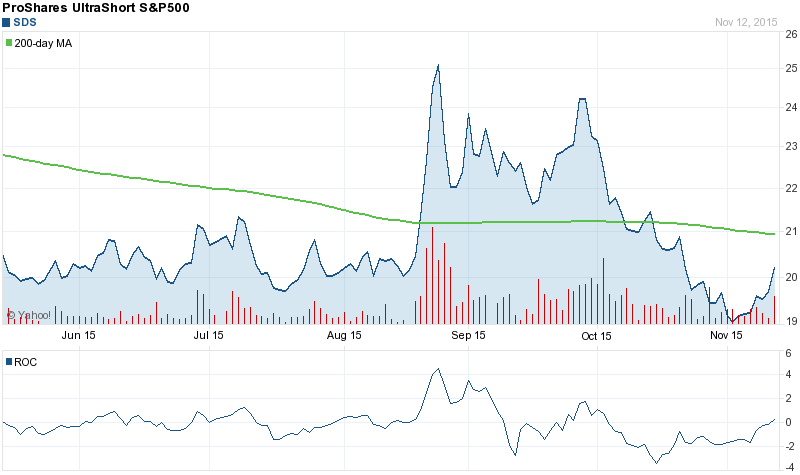

In today’s session ProShares UltraShort S&P500 (ETF) (SDS) registered an unusually high (160) contracts volume of call trades. Someone, most probably a professional was a very active buyer of the January, 2016 call, expecting serious SDS increase. With 160 contracts traded and 651 open interest for the Jan, 16 contract, it seems this is a quite bullish bet. The option with symbol: SDS160115C00018000 closed last at: $2.39 or 25.8% up. The ETF increased 2.64% or $0.52 on November 12, hitting $20.21. ProShares UltraShort S&P500 (ETF) (NYSEARCA:SDS) has declined 2.74% since April 13, 2015 and is downtrending. It has underperformed by 1.46% the S&P500.

ProShares UltraShort S&P500 seeks daily investment results that correspond to twice (200%) the inverse (opposite) of the daily performance of the S&P 500 (the Index). The ETF has a market cap of $1.61 billion. The Index is a measure of large-cap the United States stock market performance. It currently has negative earnings. It is a float-adjusted, market capitalization-weighted index of 500 United States operating companies and real estate investment trusts selected through a process that factors criteria, such as liquidity, price, market capitalization and financial viability.

ProShares UltraShort S&P500; - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.