Seadrill Ltd (NYSE:SDRL) Stock Target Increased

In an analyst note issued by Deutsche Bank on Monday, 28 September, Seadrill Ltd (NYSE:SDRL) had its target upped to $13.00. The firm at present has Hold rating on the stock.

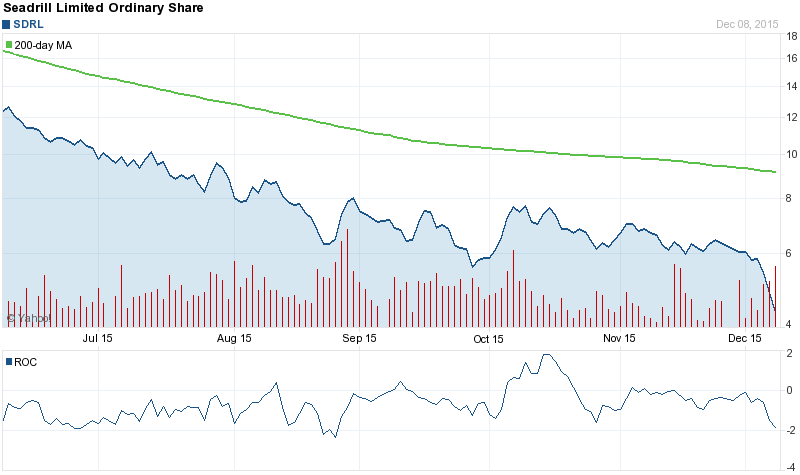

In spite of the target upgrade, NYSE:SDRL is right now trading -8.25% lower at $5.67 as of 13:18 New York time. Seadrill Ltd shares have declined -49.22% in the past 200 days, while the Standard & Poor’s 500 index has dropped -6.24% for the same time period.

Out of 13 analysts covering Seadrill Ltd, 4 rate it a Buy, 6 indicate a Hold while 5 suggest a Sell. The highest target is $24 and the lowest is $5 according to Thomson/First Call. The 12-month mean target is $11.37, which means upside potential of 100.53% over the current price.

Seadrill Ltd (NYSE:SDRL) Profile

Seadrill Limited is an offshore drilling contractor providing offshore drilling services to the oil and gas industry. The Company’s primary business is the ownership and operation of drillships, semi-submersible rigs and jack-up rigs for operations in shallow and deep water areas, as well as benign and harsh environments. The Company has three operating segments: Floaters, Jack-ups rigs and Other.

Seadrill Ltd (NYSE:SDRL) traded down -8.25% on 28 September, hitting $5.67. A total of 8.65M shares of the company’s stock traded hands. This is down from average of 13.92M shares. Seadrill Ltd has a 52 week low of $5.65 and a 52 week high of $27.61. The company has a market cap of $2.96B and a P/E ratio of 2.51.