BlackBerry (NASDAQ:BBRY) Rating Reiterated

They currently have a $7.50 target price per share on BlackBerry (NASDAQ:BBRY). UBS’s target would suggest a potential upside of 21.56% from the company’s last stock close price. This was shown in a research note on Monday, 28 September.

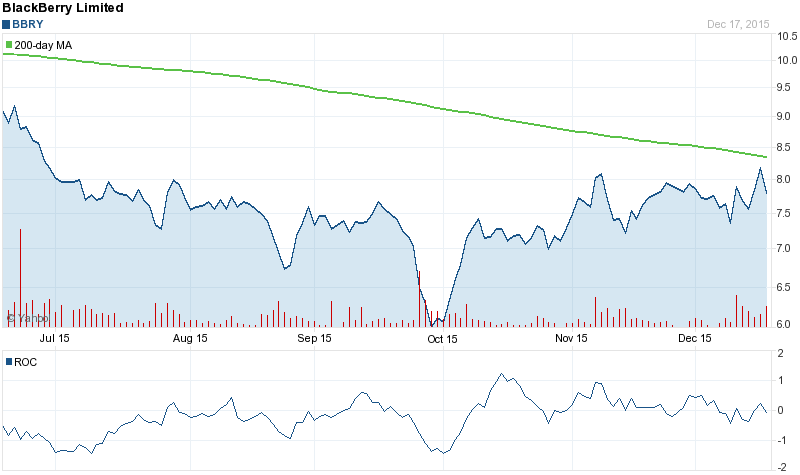

NASDAQ:BBRY is at the moment trading -4.93% lower at $6.17 as of 13:49 New York time. BlackBerry’s stock is down -38.01% over the past 200 days. It has underperformed the Standard & Poor’s 500 index, which has declined -6.24% over the same time.

BlackBerry (NASDAQ:BBRY) Profile

BlackBerry Limited (BlackBerry) is a provider of mobile communications and services. The Company is engaged primarily in the provision of the BlackBerry wireless solution, consisting of smartphones, service and software. The Company’s four areas of business are Devices business, Enterprise Services, BlackBerry Technology Solutions (BTS) business and Messaging.

BlackBerry (NASDAQ:BBRY) traded down -4.93% on 28 September, hitting $6.17. A total of 7.98 million shares of the company’s stock traded hands. This is up from average of 7.08M shares. BlackBerry has a 52 week low of $6.14 and a 52 week high of $12.63. The company has a market cap of $3.40 billion and a P/E ratio of 0.