Banco Santander (NYSE:SAN) Stock Target Raised

In analysts report shared with investors and clients by RBC Capital Markets on 28 September, Banco Santander (NYSE:SAN) had its TP decreased to $6.10. The firm at present has Sector Perform rating on the stock.

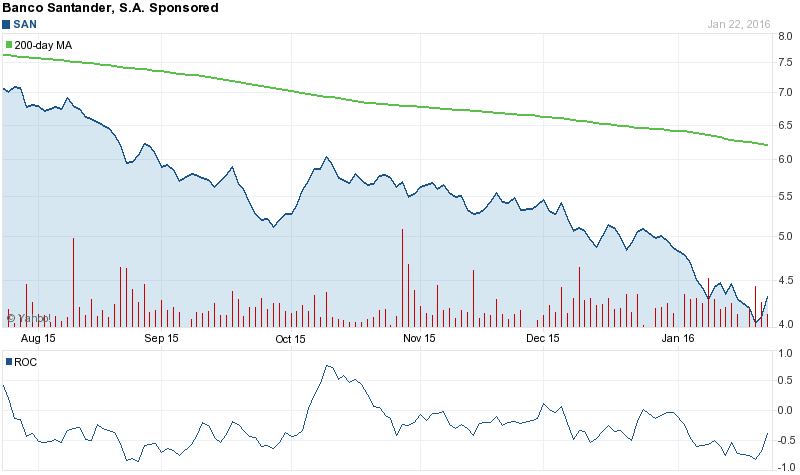

The target decrease is probably noticed by equity trades, as NYSE:SAN is right now trading -1.82% lower at $5.12 as of 15:17 New York time. Banco Santander’s stock is down -36.77% in the last 200 days. It has underperformed the S&P 500 Index, which has declined -6.24% in the same time period.

Banco Santander (NYSE:SAN) Profile

Banco Santander, S.A. is a Spain-based banking company. The Bank’s business segments include Retail Banking, which includes customer banking businesses; Global Wholesale Banking (GBM), which includes global corporate banking, investment banking and markets; Private Banking, Asset Management and Insurance, which include design and management of mutual and pension funds and insurance, and Spain’s run-off real estate, which includes loans to customers in Spain. It has operations in Continental Europe, which includes retail banking business, wholesale banking, and private banking and asset management and insurance, as well as the unit of Runoff Real Estate Activity in Spain; the United Kingdom, which include retail and wholesale banking, and private banking asset management and insurance; Latin America, which include financial activities conducted through its subsidiary banks and subsidiaries, and United States, which include the businesses of Santander Bank and Santander Puerto Rico.

Banco Santander (NYSE:SAN) traded down -1.82% on 28 September, hitting $5.12. A total of 4.86 million shares of the company’s stock traded hands. This is down from average of 6.48 million shares. Banco Santander has a 52 week low of $5.12 and a 52 week high of $9.79. The company has a market cap of $75.32 billion and a P/E ratio of 7.99.