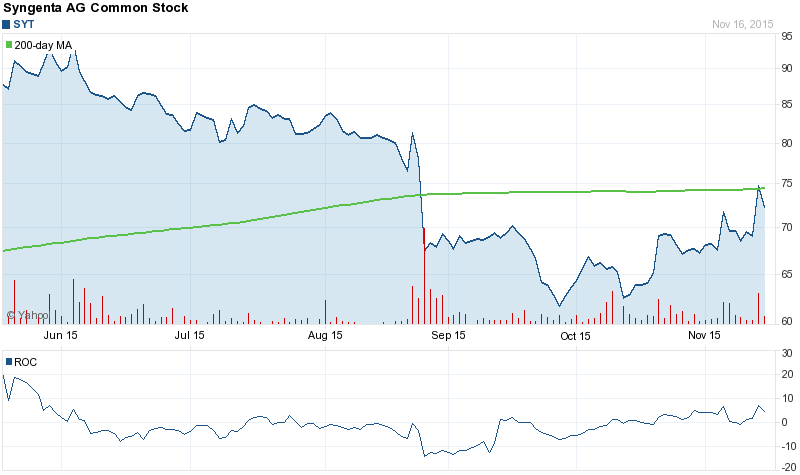

In today’s session Syngenta AG (ADR) (SYT) registered an unusually high (133) contracts volume of call trades. Someone, most probably a professional was a very active buyer of the December, 2015 call, expecting serious SYT increase. With 133 contracts traded and 790 open interest for the Dec, 15 contract, it seems this is a quite bullish bet. The option with symbol: SYT151218C00090000 closed last at: $1.2 or 44.2% down. The stock decreased 3.62% or $2.86 during the last trading session, hitting $76.2. About 1.60 million shares traded hands or 168.52% up from the average. Syngenta AG (ADR) (NYSE:SYT) has risen 10.43% since April 16, 2015 and is uptrending. It has outperformed by 13.03% the S&P500.

Out of 3 analysts covering Syngenta (NYSE:SYT), 1 rate it “Buy”, 1 “Sell”, while 1 “Hold”. This means 33% are positive. Syngenta was the topic in 3 analyst reports since August 27, 2015 according to StockzIntelligence Inc.

Syngenta AG is an agribusiness operating in the crop protection, seeds and lawn and garden markets. The company has a market cap of $34.52 billion. The Firm operates five operating divisions: the four geographic regions, consisting of the integrated Crop Protection and Seeds business, and the global Lawn and Garden business. It has 24.23 P/E ratio. The Company’s Crop Protection segment offers crop protection chemicals, which include herbicides, insecticides, fungicides and seed treatments to control weeds, insects and diseases in crops, and are inputs enabling growers.

Syngenta AG - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.