The stock of Rio Tinto plc (ADR) (NYSE:RIO) gapped up by $0.12 today and has $49.38 target or 44.00% above today’s $34.29 share price. The 6 months technical chart setup indicates low risk for the $98.98 billion company. The gap was reported on Nov, 18 by Barchart.com. If the $49.38 price target is reached, the company will be worth $43.55B more.

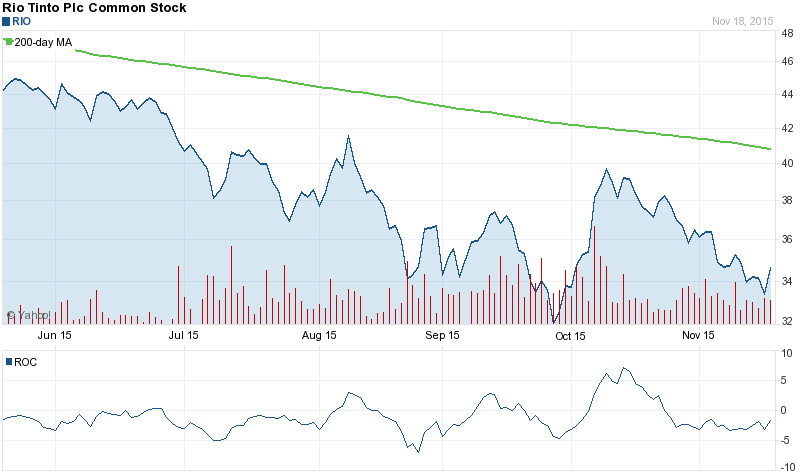

Gaps up are useful for using as a support level and to some extent as a tradeable event. If investors already hold the stock and experience a price gap up, then its usually a good idea to hold the stock for a stronger up move. Back-tests of these patterns indicate that two-thirds of the times the stock performance improves after the gap. The area gaps close 89% of the time, the breakaway gaps, 2%, the continuation gaps 4% and the exhaustion gaps 61%. The stock is up 2.57% or $0.86 after the news, hitting $34.29 per share. About 1.40 million shares traded hands. Rio Tinto plc (ADR) (NYSE:RIO) has declined 21.25% since April 16, 2015 and is downtrending. It has underperformed by 18.71% the S&P500.

Out of 8 analysts covering Rio Tinto (NYSE:RIO), 4 rate it “Buy”, 2 “Sell”, while 2 “Hold”. This means 50% are positive. Rio Tinto was the topic in 9 analyst reports since August 5, 2015 according to StockzIntelligence Inc.

According to Zacks, “Rio Tinto PLC is an international mining company. The Company has interests in mining for aluminum, borax, coal, copper, gold, iron ore, lead, silver, tin, uranium, zinc, titanium, dioxide feedstock, diamonds, talc and zircon. RTZ’s various mining operations are located in New Zealand, Australia, South Africa, Europe and Canada.”

Rio Tinto plc - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.