The stock of HSBC Holdings plc (ADR) (HSBC) gapped up by $0.84 today and has $63.76 target or 59.00% above today’s $40.10 share price. The 7 months technical chart setup indicates low risk for the $152.07B company. The gap was reported on Nov, 4 by Barchart.com. If the $63.76 price target is reached, the company will be worth $89.72 billion more.

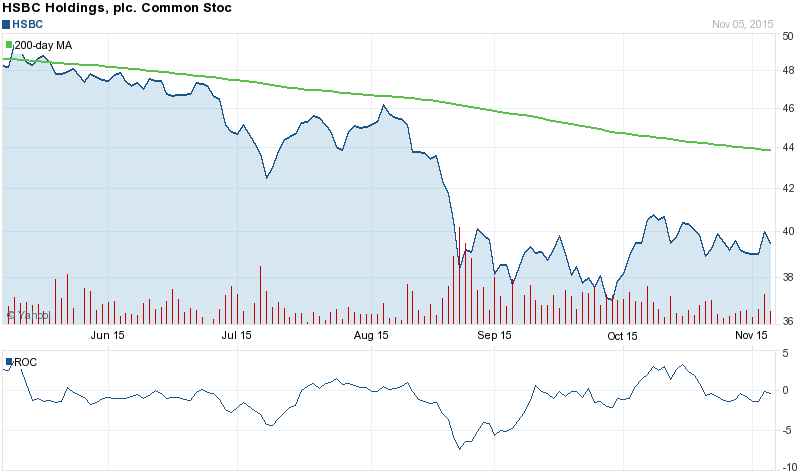

Gaps up are useful for using as a support level and to some extent as a tradeable event. If investors already hold the stock and experience a price gap up, then its usually a good idea to hold the stock for a stronger up move. Back-tests of these patterns indicate that two-thirds of the times the stock performance improves after the gap. The area gaps close 89% of the time, the breakaway gaps, 2%, the continuation gaps 4% and the exhaustion gaps 61%. The stock is up 2.77% or $1.08 after the news, hitting $40.1 per share. About 1.40M shares traded hands. HSBC Holdings plc (ADR) (NYSE:HSBC) has declined 9.09% since April 1, 2015 and is downtrending. It has underperformed by 11.52% the S&P500.

According to Zacks, “HSBC HOLDINGS is one of the largest banking and financial services organisations in the world. Through an international network linked by advanced technology, including a rapidly growing e-commerce capability, HSBC provides a comprehensive range of financial services: personal financial services; commercial banking; corporate, investment banking and markets; private banking; and other activities.”

HSBC Holdings plc - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.