Micro Focus International PLC (LON:MCRO) Rating

Investec have a GBX 1600.00 price target on the stock. The price target gives a potential upside of 8.47% from Micro Focus International PLC (LON:MCRO)’s previous stock close. This rating was revealed in an analyst note on 10 December.

Out of 11 analysts covering Micro Focus International (LON:MCRO), 8 rate it “Buy”, 0 “Sell”, while 3 “Hold”. This means 73% are positive. GBX 24.44 is the highest target while GBX 19.06 is the lowest. The GBX 21.95 average target is -1.83% below today’s (GBX 1474) stock price. Micro Focus International was the topic in 26 analyst reports since July 21, 2015 according to StockzIntelligence Inc. Liberum Capital maintained the stock on December 10 with “Hold” rating. Peel Hunt maintained it with “Buy” rating and GBX 1450 target price in a November 3 report. Numis Securities maintained the shares of MCRO in a report on December 7 with “Buy” rating. Barclays Capital maintained the firm’s rating on October 21. Barclays Capital has “Overweight” rating and GBX 1400 price target. Finally, UBS maintained the stock with “Buy” rating in a November 4 report.

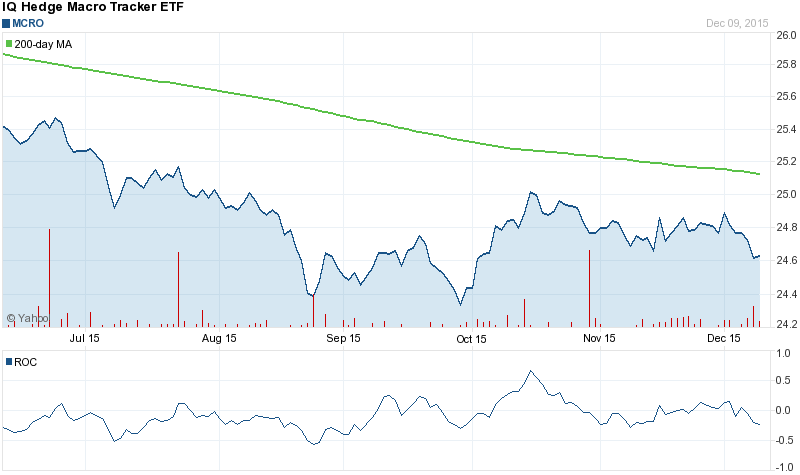

About 293,259 shares traded hands. Micro Focus International plc (LON:MCRO) has risen 3.02% since May 13, 2015 and is uptrending. It has outperformed by 4.95% the S&P500.

More important recent Micro Focus International plc (LON:MCRO) news were published by: Nasdaq.com which released: “Micro Focus H1 Pretax Profit Rises - Quick Facts” on December 10, 2015, also Fool.Co.Uk published article titled: “Should You Sell Micro Focus International plc After Results And Buy Blinkx Plc …”, Fool.Co.Uk published: “Are Gresham Computing plc And Micro Focus International plc Better Buys Than …” on August 10, 2015. More interesting news about Micro Focus International plc (LON:MCRO) was released by: Uk.Finance.Yahoo.com and their article: “PEG Ratio (5 yr expected):” with publication date: March 29, 2014.

Micro Focus International plc is a United Kingdom company, which is engaged in managing mature infrastructure software assets. The company has a market cap of 3.18 billion GBP. The Company’s products include Micro Focus, such as COBOL Development and Mainframe Solutions, Host Connectivity, Identity Access and Security, Development and IT Operations Management Tools, Collaboration and Networking, and SUSE. It has 36.62 P/E ratio. SUSE is open source software, which provides Linux and cloud infrastructure solutions.

Micro Focus International PLC - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.