Aviva (LON:AV) Rating

AlphaValue have a GBX 551 target price per share on the stock. The target price per share would suggest a potential upside of 6.68% from Aviva (LON:AV)’s last price. This rating was revealed in an analyst note on Thursday, 3 December.

Out of 18 analysts covering Aviva PLC (LON:AV), 15 rate it “Buy”, 3 “Sell”, while 4 “Hold”. This means 68% are positive. GBX 700 is the highest target while GBX 460 is the lowest. The GBX 596.28 average target is 14.65% above today’s (GBX 516.25) stock price. Aviva PLC was the topic in 66 analyst reports since July 23, 2015 according to StockzIntelligence Inc. Barclays Capital maintained the stock on December 1 with “Overweight” rating. Barclays Capital maintained it with “Overweight” rating and GBX 627 target price in a November 23 report. RBC Capital Markets downgraded the shares of AV in a report on November 26 to “Underperform” rating. Panmure Gordon maintained the firm’s rating on November 20. Panmure Gordon has “Buy” rating and GBX 660 price target. Finally, Credit Suisse maintained the stock with “Outperform” rating in a November 24 report.

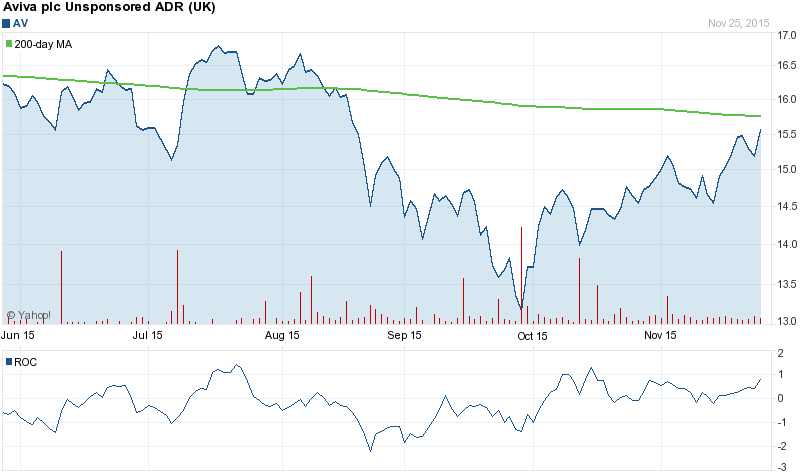

About 1.17 million shares traded hands. Aviva plc (LON:AV) has declined 0.19% since May 6, 2015 and is downtrending. It has outperformed by 0.09% the S&P500.

More notable recent Aviva plc (LON:AV) news were published by: Fool.Co.Uk which released: “Could Aviva plc, Prudential plc, Standard Life Plc & Admiral Group plc Make …” on December 02, 2015, also Fool.Co.Uk with their article: “Are Aviva plc, Prudential plc & Beazley PLC Capable Of 20%+ Returns?” published on November 26, 2015, Fool.Co.Uk published: “Are Aviva plc And Provident Financial plc Set To Soar?” on November 18, 2015. More interesting news about Aviva plc (LON:AV) were released by: Fool.Co.Uk and their article: “Which Financial Stock Will Make You Rich: Aviva plc, Banco Santander SA Or …” published on November 10, 2015 as well as Fool.Co.Uk‘s news article titled: “4 Top Dividend Growth Stocks: Prudential plc, Aviva plc, Old Mutual plc …” with publication date: November 24, 2015.

Aviva plc is a provider of long-term insurance and savings general and health insurance and fund management services and products. The company has a market cap of 20.80 billion GBP. The Firm operates across four lines of business: The Company’s long-term insurance and savings business, which includes a range of life insurance and savings products; general insurance, which focuses on personal and commercial lines, health insurance and fund management, which manages funds on behalf of its long-term insurance and general insurance businesses, external institutions, pension funds and retail clients. It has 14.44 P/E ratio.

According to Zacks Investment Research, “Aviva has established a competitive position in North America. In the US, the world’s largest savings market, Aviva is the leading provider of indexed annuity and indexed life insurance products. Its principal activity is the provision of financial products and services, focused on the following lines of business: long-term insurance and savings business, fund management and general insurance and health. The company’s business is managed on a geographic basis through a regional management structure based on four regions, U.K., Europe, North America and Asia Pacific. The four regions function as five operating segments as, due to the size of the U.K. region, it is split into two operating segments, U.K. Life and U.K. General Insurance, which undertake long term insurance and savings business and general insurance respectively.” Get a free copy of the Zacks research report on Aviva plc (AV).

Aviva - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.