Derwent London (LON:DLN) Rating

Investment analysts at JP Morgan Cazenove have GBX 4150.00 target on Derwent London (LON:DLN). JP Morgan Cazenove’s target means a potential upside of 14.33% from the company’s previous stock close. The rating was revealed to investors in an analyst report on 13 November.

Out of 17 analysts covering Derwent London (LON:DLN), 7 rate it “Buy”, 0 “Sell”, while 10 “Hold”. This means 41% are positive. GBX 4307 is the highest target while GBX 3 is the lowest. The GBX 3713.94 average target is 2.23% above today’s (GBX 3633) stock price. Derwent London was the topic in 38 analyst reports since August 3, 2015 according to StockzIntelligence Inc. JP Morgan maintained the stock on November 13 with “Overweight” rating. Deutsche Bank maintained it with “Hold” rating and GBX 3510 target price in an October 21 report. Panmure Gordon maintained the shares of DLN in a report on November 12 with “Buy” rating. BNP Paribas maintained the firm’s rating on October 13. BNP Paribas has “Neutral” rating and GBX 4000 price target. Finally, Credit Suisse maintained the stock with “Neutral” rating in an October 26 report.

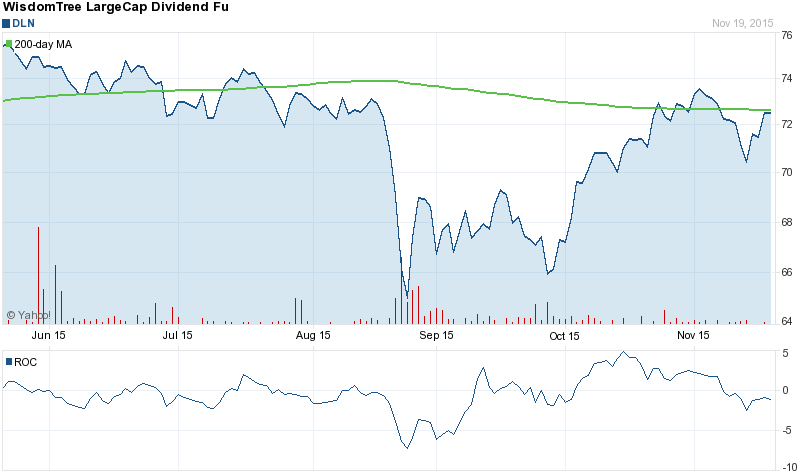

About 1,253 shares traded hands. Derwent London Plc (LON:DLN) has risen 3.52% since April 16, 2015 and is uptrending. It has outperformed by 5.74% the S&P500.

Derwent London Plc is a United Kingdom real estate investment trust operating in central London region. The company has a market cap of 4.02 billion GBP. The Firm owns and manages a portfolio of 5.7 million square feet located in 17 villages in London’s West End and City borders and focus on middle market rents. It has 5.43 P/E ratio. The Company’s property portfolio includes investment property, owner-occupied property and trading property.

Derwent London - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.