Anglo American PLC (LON:AAL) Rating

They currently have a GBX 750.00 target on Anglo American PLC (LON:AAL). Credit Suisse’s target would suggest a potential upside of 129.15% from the company’s last price. This was shown in analysts report on Wednesday, 9 December.

Out of 25 analysts covering Anglo American PLC (LON:AAL), 5 rate it “Buy”, 9 “Sell”, while 14 “Hold”. This means 18% are positive. GBX 19.57 is the highest target while GBX 4.52 is the lowest. The GBX 9.04 average target is 106.68% above today’s (GBX 327.3) stock price. Anglo American PLC was the topic in 131 analyst reports since July 22, 2015 according to StockzIntelligence Inc. Jefferies downgraded the stock on December 9 to “Underperform” rating. Bernstein maintained it with “Outperform” rating and GBX 1010 target price in a December 7 report. Barclays Capital maintained the shares of AAL in a report on December 9 with “Underweight” rating. Macquarie Research maintained the firm’s rating on November 30. Macquarie Research has “Neutral” rating and GBX 740 price target. Finally, RBC Capital Markets maintained the stock with “Sector Perform” rating in a December 8 report.

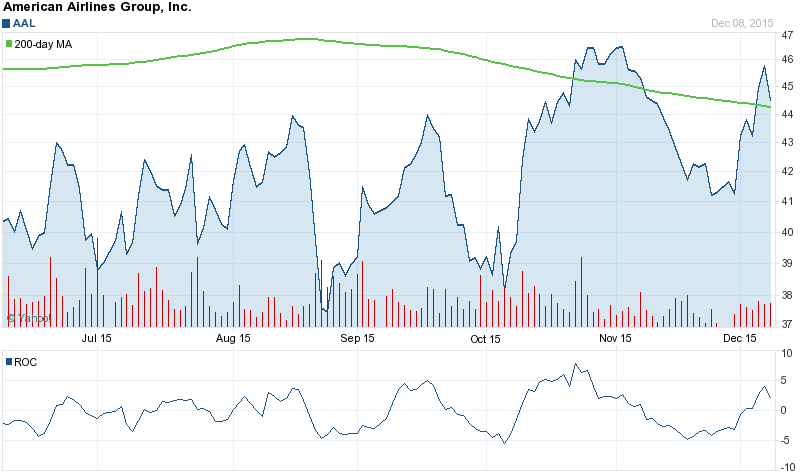

The stock increased 1.13% or GBX 3.65 on December 8, hitting GBX 327.3. Anglo American plc (LON:AAL) has declined 71.41% since May 12, 2015 and is downtrending. It has underperformed by 70.61% the S&P500.

The institutional sentiment decreased to 0.96 in 2015 Q3. Its down 0.07, from 1.03 in 2015Q2. The ratio fall, as 67 funds sold all Anglo American plc shares owned while 230 reduced positions. 67 funds bought stakes while 217 increased positions. They now own 462.75 million shares or 3.89% less from 481.50 million shares in 2015Q2.

Knighthead Capital Management Llc holds 15.57% of its portfolio in Anglo American plc for 1.54 million shares. Contrarian Capital Management L.L.C. owns 673,480 shares or 13.15% of their US portfolio. Moreover, Candlewood Investment Group Lp has 8.11% invested in the company for 250,000 shares. The New York-based Cyrus Capital Partners L.P. has invested 6.9% in the stock. Nokomis Capital L.L.C., a Texas-based fund reported 611,900 shares.

Since March 25, 2015, the stock had 0 insider purchases, and 5 insider sales for $11.61 million net activity. Parker W Douglas sold 60,362 shares worth $2.31 million. Johnson Stephen L sold 87,161 shares worth $4.29M. Kerr Derek J sold 2,250 shares worth $111,150. Isom Robert D Jr sold 94,765 shares worth $4.66M. The insider Kirby J Scott sold 262,471 shares worth $12.99 million.

More notable recent Anglo American plc (LON:AAL) news were published by: Businessfinancenews.com which released: “Anglo American plc (ADR) Announces Restructuring Plans” on December 08, 2015, also Fool.Co.Uk with their article: “3 Top Resources Stocks For 2016? Rio Tinto plc, Anglo American plc & BowLeven PLC” published on December 08, 2015, Seekingalpha.com published: “Anglo American to consolidate, sell assets, suspend dividends” on December 08, 2015. More interesting news about Anglo American plc (LON:AAL) were released by: Fool.Co.Uk and their article: “Is It Too Late To Save Stricken Glencore PLC & Anglo American plc?” published on December 03, 2015 as well as Fool.Co.Uk‘s news article titled: “Fear the Double-Digit Yields at Anglo American plc, BHP Billiton plc …” with publication date: December 02, 2015.

Anglo American PLC is a mining company. The company has a market cap of 5.19 billion GBP. The Company’s divisions include Iron Ore and Manganese, which includes iron ore, manganese ore and alloys; Coal, which includes metallurgical coal and thermal coal; Copper, which includes copper; Nickel, which includes nickel; Niobium, which includes niobium; Phosphates, which includes phosphates; Platinum, which includes platinum group metals, and De Beers, which includes rough and polished diamonds. It currently has negative earnings. The Company’s portfolio offers bulk commodities and base metals to precious metals and diamonds (through De Beers).

According to Zacks Investment Research, “American Airlines Group Inc. operates in the airline industry. The company provides scheduled passenger, freight and mail service primarily in North America, the Caribbean, Latin America, Europe and the Pacific. American Airlines Group Inc. is the holding company for American Airlines and US Airways. American Airlines Group Inc. is based in FORT WORTH TX.” Get a free copy of the Zacks research report on Anglo American plc (AAL).

Anglo American PLC - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.