MTU Aero Engines (ETR:MTX) Rating

MTU Aero Engines (ETR:MTX) had its stock rating noted as “Neutral” by analysts at Goldman Sachs Group Inc.. Goldman Sachs Group Inc. currently has a EUR 102.00 target on the 4.81 billion EUR market cap company or 10.25% upside potential. This was shown in a report on 3 December.

Out of 4 analysts covering MTU Aero Engines (ETR:MTX), 5 rate it “Buy”, 0 “Sell”, while 1 “Hold”. This means 83% are positive. €85 is the highest target while €68 is the lowest. The €73.25 average target is 4.17% above today’s (€92.5) stock price. MTU Aero Engines was the topic in 30 analyst reports since July 16, 2015 according to StockzIntelligence Inc. Warburg Research upgraded the stock on December 1 to “Buy” rating. S&P Research upgraded it to “Buy” rating and €95 target price in an October 28 report. Equinet upgraded the shares of MTX in a report on November 27 to “Accumulate” rating. Landesbank upgraded the firm’s rating on October 28. Landesbank has “Buy” rating and €107 price target. Finally, Bankhaus Lampe upgraded the stock to “Buy” rating in a November 27 report.

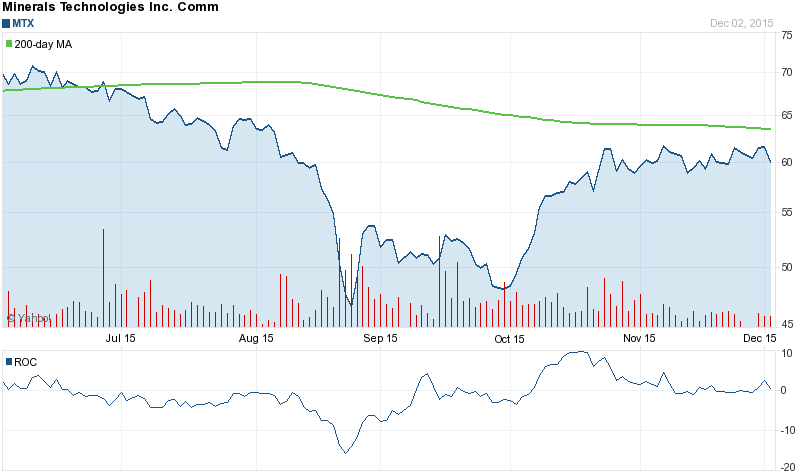

The stock decreased 0.38% or EUR 0.35 on December 2, hitting EUR 92.5. About 147,698 shares traded hands. MTU Aero Engines AG (ETR:MTX) has declined 11.27% since April 30, 2015 and is downtrending. It has underperformed by 11.07% the S&P500.

MTU Aero Engines AG, formerly Mtu Aero Engines Holding AG, is a Germany holding firm engaged in the design, development and manufacture of engine modules and components for the military and commercial aircrafts. The company has a market cap of 4.81 billion EUR. The Firm also manufactures complete engines and makes industrial gas turbines. It has 22.13 P/E ratio. The Firm divided its business activities into two divisions: Original Equipment Manufacturing , covering the Company’s activities related to the design and manufacture of new engines and spare parts for commercial engine business and the military engine business, and Maintenance, Repair and Overhaul (MRO) segment, engaged in the provision of maintenance services, including the repair and overhaul of aircraft engines and industrial gas turbines, organized under MTU Maintenance.

According to Zacks Investment Research, “Minerals Technologies Inc. is a resource and technology-based company that develops, produces and markets on a worldwide basis a broad range of specialty mineral, mineral-based and synthetic mineral products. The Company has two operating segments: Specialty Minerals and Refractories. The Specialty Minerals segment produces and sells precipitated calcium carbonate and lime, and mines, processes and sells the natural mineral products limestone and talc. The Refractories segment produces and markets monolithic and shaped refractory materials and services.” Get a free copy of the Zacks research report on MTU Aero Engines AG (MTX).

MTU Aero Engines - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.