Sentiment for Bank Of America Corp (NYSE:BAC)

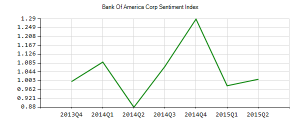

Bank Of America Corp (NYSE:BAC) institutional sentiment increased to 1.01 in Q2 2015. Its up 0.03, from 0.98 in 2015Q1. The ratio has increased, as 617 institutional investors started new and increased positions, while 609 cut down and sold their positions in Bank Of America Corp. The institutional investors in our partner’s database now own: 6.35 billion shares, up from 6.24 billion shares in 2015Q1. Also, the number of institutional investors holding Bank Of America Corp in their top 10 positions increased from 108 to 137 for an increase of 29. Sold All: 86 Reduced: 523 Increased: 498 New Position: 119.

Bank of America Corporation is a bank holding firm and a financial holding company. The company has a market cap of $181.07 billion. The Firm is a financial institution, serving individual consumers, small- and middle-market businesses, institutional investors, firms and Governments with a range of banking, investing, asset management and other financial and risk management services and products. It has 12.91 P/E ratio. Through its banking and various nonbank subsidiaries, it provides a range of banking and nonbank financial services and products.

The stock closed at $17.43 during the last session. It is down 11.45% since April 15, 2015 and is uptrending. It has outperformed by 13.98% the S&P500.

Bank of America Corp. is one of the world’s leading financial services companies. Bank of America provides individuals, small businesses and commercial, corporate and institutional clients across the United States and around the world new and better ways to manage their financial lives. The company enables customers to do their banking and investing whenever, wherever and however they choose.

Mizuho Bank Ltd. holds 48.78% of its portfolio in Bank of America Corp for 31.25 million shares. Boyle Capital Management Llc owns 1.91 million shares or 32.65% of their US portfolio. Moreover, Daily Journal Corp has 28.95% invested in the company for 2.30 million shares. The New York-based Geduld E E has invested 26.54% in the stock. Fairholme Capital Management Llc, a Florida-based fund reported 75.49 million shares.

Since July 23, 2015, the stock had 0 buys, and 1 sale for $135,831 net activity. Nguyen Thong M sold 7,520 shares worth $135,831.

Ratings analysis reveals 67% of Bank of America’s analysts are positive. Out of 15 Wall Street analysts rating Bank of America, 10 give it “Buy”, 0 “Sell” rating, while 5 recommend “Hold”. The lowest target is $17 while the high is $21. The stock’s average target of $18.97 is 8.84% above today’s ($17.43) share price. BAC was included in 30 notes of analysts from July 21, 2015. Jefferies maintained the shares of Bank of America in a note on October 7 with “Buy” rating. UBS upgraded BAC’s stock on an August 26. UBS has “Neutral” rating and $20 PR. Bernstein upgraded Bank of America’s stock on September 1 to “Buy” rating. Robert W. Baird upgraded it ^with/to4^ “Neutral” rating and $18.0 PT in August 25 note. Finally, Macquarie Research upgraded the shares of Bank of America to “Hold” rating in a September 1 note.

Bank Of America Corp - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.