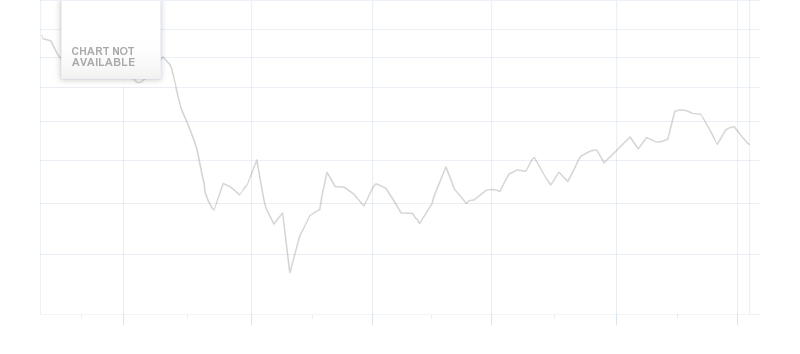

Investors wait BRP Inc (TSE:DOO) to report on December, 11. its quarterly earningsWall Street analysts expect $0.45 earnings per share, down $0.15 or 25.00% from last year’s $0.6 same quarter earnings. This translates into $16.36 million profit for T_DOO giving the stock a 11.16 P/E. Of course only in case the $0.45 EPS is accurate. BRP Inc’s Wall Street analysts see 1,400.00% EPS growth, taking into account the $0.03 EPS reproted in the previous quarter, The stock decreased 2.76% or $0.57 on December 9, hitting $20.08. About 105,248 shares traded hands or 86.84% up from the average. BRP Inc (TSE:DOO) has declined 24.51% since May 7, 2015 and is downtrending. It has underperformed by 22.58% the S&P500.

Another recent and important BRP Inc (TSE:DOO) news was published by Jsonline.com which published an article titled: “BRP Inc. rocks the industry’s boat with new motor” on June 14, 2014.

BRP Inc. is a Canada-based company engaged in design, development, manufacturing, distribution and marketing of power sports vehicles and propulsion systems. The company has a market cap of $729.89 million. The Firm has four product categories: the year-round products; the seasonal products; the propulsion systems, and parts, accessories and clothing products. It has 39.79 P/E ratio. The Company’s year-round products consist of Can-Am ATVs, recreational SSVs and Spyder roadsters.

BRP Inc - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.