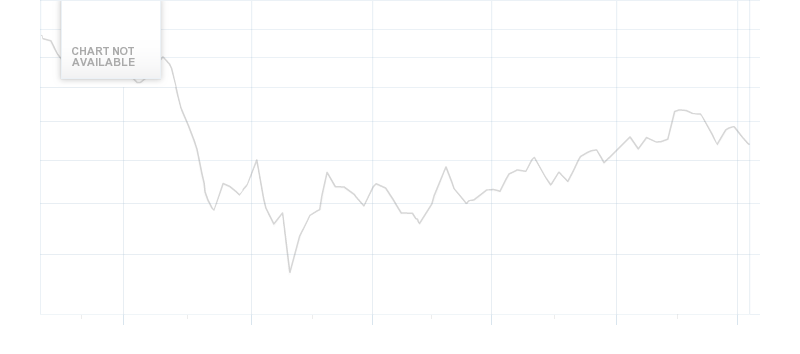

Investors wait Pretium Resources Inc (TSE:PVG) to report on November, 5. its quarterly earningsWall Street analysts expect $-0.03 earnings per share, up $0.01 or 25.00% from last year’s $-0.04 same quarter earnings. Pretium Resources Inc’s Wall Street analysts see 50.00% negative EPS growth, taking into account the $-0.02 EPS reproted in the previous quarter, About 233,566 shares traded hands. Pretium Resources Inc (TSE:PVG) has risen 19.91% since March 31, 2015 and is uptrending. It has outperformed by 17.47% the S&P500.

Out of 6 analysts covering Pretium Resources (TSE:PVG), 5 rate it “Buy”, 0 “Sell”, while 1 “Hold”. This means 83% are positive. $15 is the highest target while $8.50 is the lowest. The $11.81 average target is 60.68% above today’s ($7.35) stock price. Pretium Resources was the topic in 9 analyst reports since August 24, 2015 according to StockzIntelligence Inc.

Pretium Resources Inc. is a Canada-based exploration and development company. The company has a market cap of $974.48 million. The Firm is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas. It currently has negative earnings. The Company’s wholly owned projects include Brucejack Project and the Snowfield Project.

Pretium Resources Inc - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.