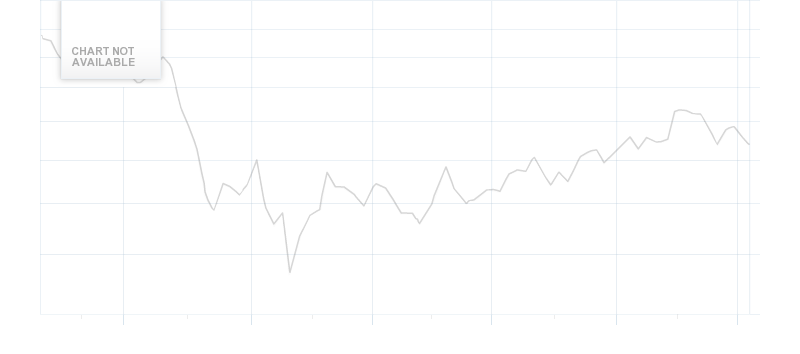

Investors wait Empire Company Limited (TSE:EMP) to report on December, 11. its quarterly earningsWall Street analysts expect $0.44 EPS, down $0.02 or 4.35% from last year’s $0.46 same quarter earnings. This translates into $119.51 million profit for T_EMP giving the stock a 14.79 P/E. Of course only in case the $0.44 EPS is accurate. Empire Company Limited’s Wall Street analysts see 0.00% EPS growth, taking into account the $0.44 EPS reproted in the previous quarter, The stock increased 3.09% or $0.78 on December 9, hitting $26.03. About 1.12M shares traded hands or 379.06% up from the average. Empire Company Limited (TSE:EMP.A) has declined 90.21% since May 13, 2015 and is downtrending. It has underperformed by 88.28% the S&P500.

Out of 3 analysts covering Empire Company Limited (TSE:EMP.A), 1 rate it “Buy”, 0 “Sell”, while 2 “Hold”. This means 33% are positive. $92 is the highest target while $86 is the lowest. The $88.50 average target is 239.99% above today’s ($26.03) stock price. Empire Company Limited was the topic in 5 analyst reports since September 10, 2015 according to StockzIntelligence Inc. Scotia Capital maintained the stock on September 11 with “Sector Outperform” rating.

More notable recent Empire Company Limited (TSE:EMP.A) news were published by: Fool.ca which released: “Should You Buy Empire Company Limited After the 9% Drop?” on September 11, 2015, also Fool.ca with their article: “Should Investors Buy Empire Company Ltd. After its Disappointing Quarterly …” published on September 16, 2015, Fool.ca published: “Is Now the Prime Time to Buy Empire Company Limited?” on September 14, 2015. More interesting news about Empire Company Limited (TSE:EMP.A) were released by: Fool.ca and their article: “Should You Buy or Avoid Empire Company Limited Today?” published on June 25, 2015 as well as Fool.ca‘s news article titled: “Empire Company Limited or Loblaw Companies Limited: Which Grocer Should You Own?” with publication date: February 11, 2015.

Empire Company Limited is engaged in the business of food retailing and related real estate. The company has a market cap of $7.07 billion. The Firm operates through two divisions: Food Retailing and Investments and Other Operations. It has 17.84 P/E ratio. The Company’s Food Retailing segment is carried out through its wholly owned subsidiary, Sobeys Inc., which has conducted business through approximately 1,500 retail stores , as well as over 350 retail fuel locations, operating in province and in over 900 communities across Canada.

Empire Company Limited - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.